Essay

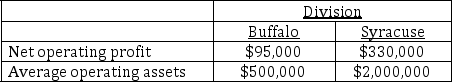

AP Industries has two divisions, located in Buffalo and Syracuse. Financial metrics for each division for the most recently concluded year are given in the table below:

For purposes of computing residual income, the corporation employs a 14% weighted average cost of capital.

For purposes of computing residual income, the corporation employs a 14% weighted average cost of capital.

Required:

a) Compute ROI for both the Buffalo and Syracuse divisions.

b) Compute residual income for both the Buffalo and Syracuse divisions.

c) How does the performance of the divisions compare? Discuss the shortcoming of residual income as a comparative measure of divisional performance.

Correct Answer:

Verified

AP Industries has two divisions located ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: P & M Corporation manufactures products exclusively

Q26: Pinehurst Company has two divisions, Household Appliances

Q27: One definition of the value of an

Q28: A transfer price should exclude any variable

Q29: P & M Corporation manufactures products exclusively

Q31: The preparation of an operating budget is

Q32: Manhattan Corporation has several divisions that operate

Q33: Many companies assess performance using what are

Q34: In the United States, generally accepted accounting

Q35: A minimum transfer price should cover the