Multiple Choice

Answer the following question(s) using the information below:

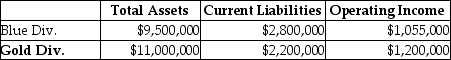

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:

-What is Economic Value Added (EVA) for the Gold Division?

A) -$283,200

B) -$82,560

C) $196,800

D) $397,440

E) -$195,200

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Alpine Ltd. has two divisions. Division A

Q32: Consolidated Gas Supply Corporation uses the investment

Q33: Broughton Industries Ltd. is a publicly traded

Q34: Use the information below to answer the

Q35: Coptermagic Company supplies helicopters to corporate clients.

Q37: Use the information below to answer the

Q38: The Irnakk Corporation manufactures iPod covers in

Q39: Use the information below to answer the

Q40: The Coffee Division of Canadian Products is

Q41: Use the information below to answer the