Essay

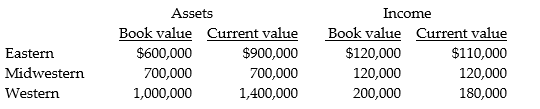

National Can Company has three divisions, Eastern, Midwestern, and Western. Because of very different accounting methods and inflation rates in different countries it is considering multiple evaluation measures. Information gathered about the divisions for the year just ended follows:

The company is currently using a required rate of return of 15 percent.

Required:

a. Compute the ROI using both book value and current value for all divisions. Round to three decimal places.

b. Compute residual income using book value and current value for all divisions.

c. Does book value or current value provide the better basis for performance evaluation? Why? Which division is the most successful?

Correct Answer:

Verified

a.

Book value ROI: Eastern = $120,000/$6...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Book value ROI: Eastern = $120,000/$6...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: Use the information below to answer the

Q43: Use the information below to answer the

Q44: Which of the following is NOT a

Q45: Use the information below to answer the

Q46: The Shamrock Corporation manufactures flower pots in

Q48: Last year Reynolds Ltd. reported the following

Q49: Answer the following question(s) using the information

Q50: Use the information below to answer the

Q51: How should environmental and ethical issues affect

Q52: Use the information below to answer the