Multiple Choice

Use the information below to answer the following questions:

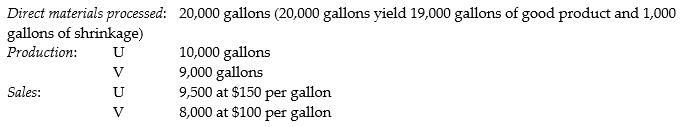

Argon Manufacturing Company processes direct materials up to the splitoff point where two products (U and V) are obtained and sold. The following information was collected for last quarter of the calendar year:

The cost of purchasing 20,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 19,000 gallons of good products was $1,950,000.

Beginning inventories totaled 100 gallons for U and 50 gallons for V. Ending inventory amounts reflected 600 gallons of Product U and 1,050 gallons of Product V. October costs per unit were the same as November.

-What is the joint cost allocation to product U using the sales value at splitoff method?

A) $1,218,750

B) $731,250

C) $1,248,876

D) $701,124

E) $1,026,285

Correct Answer:

Verified

Correct Answer:

Verified

Q47: The incremental benefit or (loss) of processing

Q48: Match each of the following costs with

Q49: Answer the following question(s) using the information

Q50: Answer the following question(s) using the information

Q51: Use the information below to answer the

Q52: A business which enters into a contract

Q53: The incremental benefit or (loss) of processing

Q54: Yip Manufacturing purchases trees from Cheney Lumber

Q56: If managers make processing or selling decisions

Q57: Framingham Ltd. produces three products out of