Multiple Choice

Use the information below to answer the following question(s) .

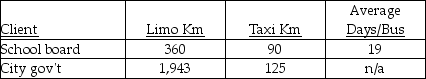

A transportation company provides bussing, limo and taxi service. The company charges: $350 per day for bussing service; $2.00 per kilometre for taxi service; and, $3.50 per kilometre for limo service. Two individual clients, the school board and the city government offices use the majority of the limo service on a contract agreement. Bussing services are used exclusively by the school board, and the taxi service is used almost exclusively by the general public, although the school board uses the taxi services when individual students have to be transported on occasion. Indirect costs are accumulated on internal records at $1.50 per kilometre for limo use and $1.00 per kilometre for taxi use, and $195 per day for each of the twenty buses.

The company's costing system has tracked the following activities for the month:

-Compute the billing to each major client for the month.

A) School Board, $134,440.00; City Gov't, $7,050.50

B) School Board, $8,090.00; City Gov't, $134,440.00

C) School Board, $134,440.00; City Gov't, $4,323.50

D) School Board, $7,050.50; City Gov't, $7,685.00

E) School Board, $8,090.00; City Gov't, $7,050.50

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Match the cost driver in the right

Q2: A cost accounting system should be revised

Q3: Using activity-based costing to allocate overhead costs,

Q4: Asian Tools, a manufacturer of precision hand

Q5: The Guy Fawkes Company is noted for

Q7: Come-On-In Manufacturing produces two types of entry

Q8: How does direct cost tracing improve cost

Q9: Brewery Company operates many bottling plants around

Q10: A company manufactures household items sold at

Q11: Eastern Star Nursing Home has been using