Multiple Choice

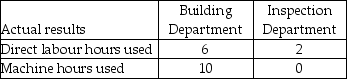

Leonard Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: Building and Inspection. The Building Department uses a departmental overhead rate of $18 per machine hour, while the Inspection Department uses a departmental overhead rate of $15 per direct labour hour. Job 611 used the following direct labour hours and machine hours in the two departments: The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 611 is $1,500.

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 611 is $1,500.

What was the total cost of Job 611 if Leonard Industries used the departmental overhead rates to allocate manufacturing overhead?

A) $1,700

B) $1,844

C) $1,880

D) $1,838

E) $1,910

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Which of the following statements about activity-based

Q15: The new manager of the insurance division

Q16: At Deutschland Electronics, product lines are charged

Q17: For each of the following activities identify

Q18: Match the cost driver in the right

Q20: Rogers Printing Ltd. has contracts to complete

Q21: Match the cost driver in the right

Q22: Match the cost driver in the right

Q23: Babcock Industries uses departmental overhead rates to

Q24: Cecelia Schell is taking four clients (who