Multiple Choice

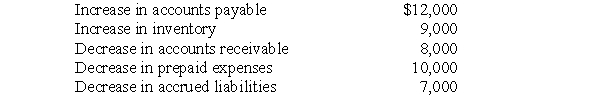

During 2010, Bates Company earned net income of $275,000 which included depreciation expense of $34,000. The company had a loss on the sale of equipment of $2,000 and the following changes in account balances occurred:

Based upon this information, what amount will be shown for net cash provided by operating activities for 2010?

A) $289,000

B) $307,000

C) $321,000

D) $323,000

E) $325,000

Correct Answer:

Verified

Correct Answer:

Verified

Q3: In its first year of operations, Sweetness

Q4: Brandt Corporation's office supplies account balance at

Q5: The objective of the statement of cash

Q6: For purposes of the statement of cash

Q7: Butler Corp.'s Retained Earnings balance at the

Q9: Glover Corporation sold a building with a

Q10: The collection of the principal amount of

Q11: During 2010, Maroon and Gold Corporation incurred

Q12: Payment of interest on a long-term loan

Q13: Under U.S. GAAP, companies using the direct