Multiple Choice

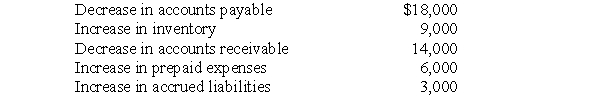

During 2010, Richards Company earned net income of $268,000 which included depreciation expense of $21,000. The company had a gain on the sale of equipment of $6,000 and the following changes in account balances occurred:

Based upon this information, what amount will be shown for net cash provided by operating activities for 2010?

A) $267,000

B) $269,000

C) $279,000

D) $289,000

E) $299,000

Correct Answer:

Verified

Correct Answer:

Verified

Q22: The following information is from Hollywood Corporation's

Q23: Which of the following is not part

Q24: Changes in which of the following accounts

Q25: Amortization of a patent is shown as

Q26: Onken Corporation's interest payable account balance at

Q28: Joyner Corporation paid interest on long-term debt.

Q29: In 2010, Garon Corp. declared and paid

Q30: Receipts from the repayment of long-term loans

Q31: Baskett Corp. bought equipment for $100,000 cash.

Q32: The following information is from Doubtfire Corporation's