Essay

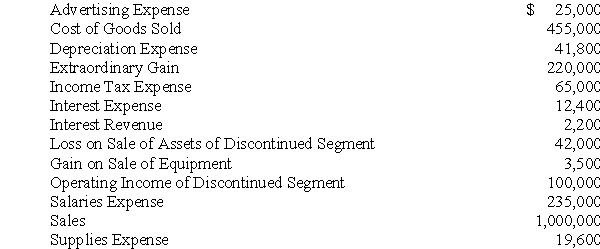

The following information is from D'Angelo Corporation's 2010 trial balance. All balances are normal balances.

Required:

a. Prepare, in good form, the income or loss from continuing operations section of D'Angelo Corp.'s income statement.

b. Prepare, in good form, the nonrecurring items section(s) of D'Angelo Corp.'s income statement. Nonrecurring items are taxed or are tax deductible at 20%.

c. What is D'Angelo's 2010 net income?

d. Information on D'Angelo Corp.'s common stock transactions during 2010 are as follows:

Jan. 1 180,000 shares

March 1 Issued 30,000 shares

Nov. 1 Purchased 12,000 shares in the market for treasury stock

Determine the weighted average number of common shares outstanding and the earnings per share for net income for D'Angelo Corp. for 2010. (Round to the nearest cent.)

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Use the following information to answer questions

Q43: Profitability ratios are often calculated in relationship

Q44: Pilgrim Incorporated reported $275,000 in taxable income

Q45: Net income is viewed as the best

Q46: In assessing the quality of a firm's

Q48: Liquidity ratios measure a firm's ability to

Q49: Use the following information to answer questions

Q50: Trend analysis is used to analyze the

Q51: Preferred stock dividends should be added to

Q52: A Deferred Tax Asset account represents taxes