Multiple Choice

Use the following information to answer questions

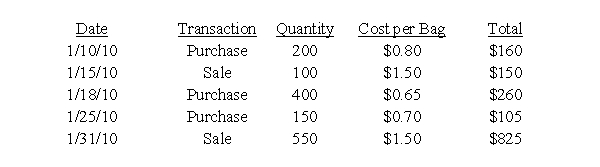

On December 31, 2009, the Italian Pasta Company's ending inventory consisted of 100 bags of fettuccine at a cost of $0.75 per bag. Throughout January 2010, the Italian Pasta Company purchased and sold additional bags of fettuccine. Refer to the table below for additional information.

-Assume that the Italian Pasta Company uses a LIFO perpetual inventory system. Cost of goods sold for January 2010, is

A) $300.00.

B) $445.00.

C) $460.00

D) $462.50.

E) $600.00.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Use the following information to answer questions

Q14: In a period of rising prices, the

Q15: When FIFO and LIFO are compared,<br>A) LIFO

Q16: Because FIFO yields lower profits than LIFO

Q17: A cost flow assumption is used when

Q19: In a perpetual inventory system,<br>A) the Inventory

Q20: The average age of inventory is calculated

Q21: LL Co. has several retail clothing stores

Q22: Use the following information to answer questions

Q23: The FIFO method of inventory costing<br>A) assumes