Multiple Choice

A machine costing $33,000 with an estimated salvage value of $3,000 is to be depreciated on a straight-line basis over five years. The machine was purchased on April 1, 2009. What year-end depreciation adjusting entry should be made on December 31, 2010?

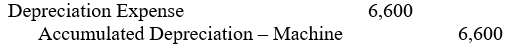

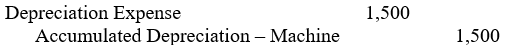

A)

B)

C)

D)

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q41: The set of accounting procedures that must

Q42: Which of the following reflects the normal

Q43: A journal entry must have one debit

Q44: The prepayment of an expense item is

Q45: An account whose period-ending balance is transferred

Q47: Which of the following reflects the normal

Q48: Which of the following statements is true?<br>A)

Q49: During 2010, Zambezi Rowing Co. generated $500,000

Q50: As used in accounting, a credit is

Q51: Companies should prepare trial balances before posting