Multiple Choice

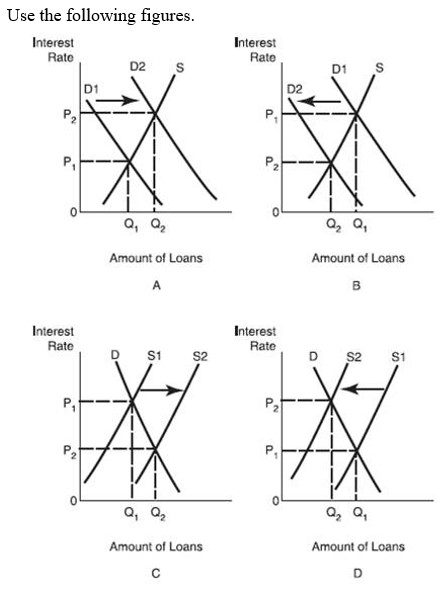

-The loan market condition illustrated by the movement from S1 to S2 in Figure C would be the immediate result of an increase in the:

A) discount rate.

B) reserve requirement.

C) Fed's purchase of securities on the open market.

D) all of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q139: Monetizing the federal debt:<br>A) intensifies the crowding

Q140: With a reserve requirement of 25 percent,

Q141: The maximum amount by which the money

Q142: If a bank has $100 million in

Q143: A financial depository institution's reserve requirement is

Q145: An increase in the interest rate will:<br>A)

Q146: If the Fed wants to expand excess

Q147: A decrease in excess reserves causes the:<br>A)

Q148: A financial depository institution's required reserves plus

Q149: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB9874/.jpg" alt=" -If the original