Essay

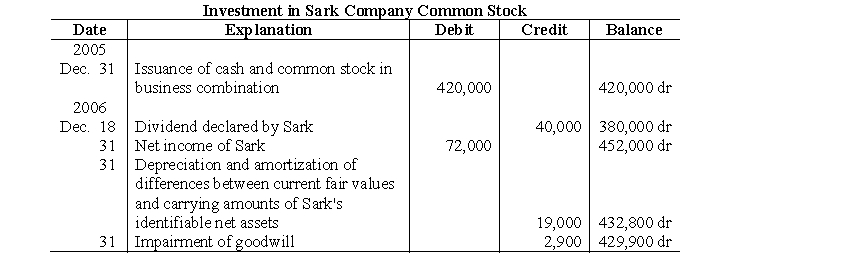

The Investment in Sark Company Common Stock ledger account of Poulter Corporation was as follows for the year ended December 31, 2006:

Poulter had acquired 80% of the outstanding common stock of Sark on December 31, 2005 in a business combination.

Poulter had acquired 80% of the outstanding common stock of Sark on December 31, 2005 in a business combination.

For the fiscal year ended December 31, 2006, Poulter had total revenue (excluding intercompany investment income) of $800,000, and total costs and expenses (including goodwill impairment loss) of $600,000. Poulter declared cash dividends of $60,000 during 2006.

a. Reconstruct Poulter Corporation's equity-method journal entries for the operations of Sark Company for 2006. Omit explanations and disregard income taxes.

b. Prepare Poulter Corporation's closing entries on December 31, 2006. Omit explanations.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Under the equity method of accounting, depreciation

Q3: If a parent company uses the equity

Q4: Skeene Company, the 70%-owned subsidiary of Probert

Q5: During the fiscal year ended October 31,

Q6: On October 1, 2006, Poon Corporation acquired

Q7: The depreciation and amortization of differences between

Q8: Dividends declared by a subsidiary subsequent to

Q9: Refer to the above facts. Assume that,

Q10: A wholly owned subsidiary credits the Dividends

Q11: Under the equity method of accounting, the