Essay

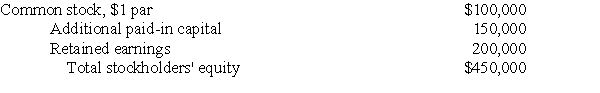

On September 30, 2005, Phoenix Corporation paid $400,000 for 75% of the outstanding $1 par common stock of Salem Company and $80,000 for legal fees in connection with the business combination. On that date, Salem's stockholders' equity was as follows:

Current fair values of Salem's inventories (first-in, first-out cost) and depreciable plant assets (net) exceeded their carrying amounts by $20,000 and $90,000, respectively, on September 30, 2005. Current fair values of Salem's other identifiable net assets equaled their carrying amounts on that date. Salem's depreciable plant assets had a composite economic life of nine years on September 30, 2005, and Salem includes straight-line depreciation expense in cost of goods sold.

Current fair values of Salem's inventories (first-in, first-out cost) and depreciable plant assets (net) exceeded their carrying amounts by $20,000 and $90,000, respectively, on September 30, 2005. Current fair values of Salem's other identifiable net assets equaled their carrying amounts on that date. Salem's depreciable plant assets had a composite economic life of nine years on September 30, 2005, and Salem includes straight-line depreciation expense in cost of goods sold.

For the fiscal year ended September 30, 2006, Salem had a net income of $80,000, but did not declare dividends. Goodwill was unimpaired on September 30, 2006.

a. Prepare Phoenix Corporation's journal entries to record the business combination of Phoenix and Salem Company on September 30, 2005.

b. Prepare a working paper elimination (in journal entry format) for Phoenix Corporation and subsidiary on September 30, 2005.

c. Prepare Phoenix Corporation's journal entries, under the equity method of accounting, to record Salem Company's operating results for the fiscal year ended September 30, 2006.

d. Prepare working paper eliminations (in journal entry format) for Phoenix Corporation and subsidiary on September 30, 2006.

Omit explanations and disregard income taxes.

Correct Answer:

Verified

a.

b.

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: On the date of the business combination

Q27: In a classroom discussion of the relative

Q28: The method of accounting for a subsidiary's

Q29: Proponents of the equity method of accounting

Q30: Under the equity method of accounting, the

Q32: If a wholly owned subsidiary's net income

Q33: Plover Corporation accounts for its 80%-owned purchased

Q34: Use of the equity method of accounting

Q35: The format of a parent company's journal

Q36: For the fiscal year ended March 31,