Multiple Choice

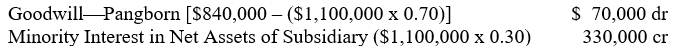

Pangborn Corporation paid $840,000 (including direct out-of-pocket costs) for 70% of the outstanding common stock of Siddon Company on September 30, 2006, the end of Pangborn's fiscal year. Included in the working paper elimination (in journal entry format) for Pangborn Corporation and subsidiary on that date were the following: If Pangborn had inferred a current fair value for 100% of Siddon's total net assets from the $840,000 cost, Goodwill and Minority Interest in Net Assets of Subsidiary in the September 30, 2006, working paper elimination would have been, respectively:

If Pangborn had inferred a current fair value for 100% of Siddon's total net assets from the $840,000 cost, Goodwill and Minority Interest in Net Assets of Subsidiary in the September 30, 2006, working paper elimination would have been, respectively:

A) $100,000 and $330,000

B) $70,000 and $360,000

C) $49,000 and $231,000

D) $100,000 and $360,000

E) Some other amounts

Correct Answer:

Verified

Correct Answer:

Verified

Q12: A parent company's control of a subsidiary

Q13: Consolidated financial statements are intended primarily for

Q14: In a business combination resulting in a

Q15: Consolidated financial statements emphasize the legal form

Q16: A subsidiary's paid-in capital ledger accounts always

Q18: A widely used method of accounting for

Q19: The Financial Accounting Standards Board requires push-down

Q20: The terms <B.special purpose entity</B> and <B>variable

Q21: Before the computation of goodwill, the debits

Q22: In a business combination resulting in a