Multiple Choice

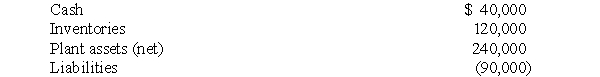

On March 1, 2006, Pride Corporation paid $400,000 for all the outstanding common stock of Supra Company in a business combination, for which out-of-pocket costs may be disregarded. The carrying amounts of Supra's identifiable assets and liabilities on March 1, 2006, follow:  On March 1, 2006, the inventories of Supra had a current fair value of $95,000, and the plant assets (net) had a current fair value of $280,000.

On March 1, 2006, the inventories of Supra had a current fair value of $95,000, and the plant assets (net) had a current fair value of $280,000.

The amount recognized as goodwill as a result of the business combination is:

A) $0

B) $25,000

C) $75,000

D) $90,000

E) Some other amount

Correct Answer:

Verified

Correct Answer:

Verified

Q29: On the date of a business combination

Q30: Working paper eliminations are entered in:<br>A) Both

Q31: Consolidated financial statements are not appropriate if:<br>A)

Q32: Consolidated financial statements are prepared when a

Q33: In a proposed <B>Statement,</B> "Consolidated Financial Statements:

Q34: How is the minority interest in net

Q35: On December 31, 2006, the balance sheet

Q36: On November 30, 2006, Pegler Corporation paid

Q37: Finance-related subsidiaries may be excluded from consolidation

Q39: All out-of-pocket costs of a business combination