Multiple Choice

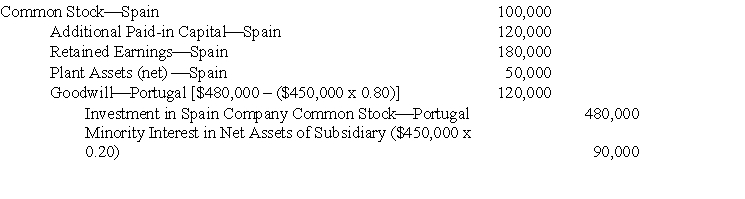

On October 31, 2006, Portugal Corporation acquired 80% of the outstanding common stock of Spain Company in a business combination. Total cost of the investment, including direct out-of-pocket costs, was $480,000. The working paper elimination (in journal entry format, explanation omitted) for Portugal Corporation and Subsidiary on October 31, 2006, was as follows:  If goodwill had been computed based on the implied current fair value of the subsidiary's total net assets, the debit to Goodwill-Portugal in the foregoing working paper elimination would have been:

If goodwill had been computed based on the implied current fair value of the subsidiary's total net assets, the debit to Goodwill-Portugal in the foregoing working paper elimination would have been:

A) $120,000

B) $150,000

C) $180,000

D) Some other amount

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Minority interest in net assets of subsidiary

Q24: On April 30, 2006, Press Corporation paid

Q25: A debit to Goodwill-Subsidiary in a working

Q26: A controlling financial interest traditionally has been

Q27: Because minority stockholders exercise no ownership control

Q29: On the date of a business combination

Q30: Working paper eliminations are entered in:<br>A) Both

Q31: Consolidated financial statements are not appropriate if:<br>A)

Q32: Consolidated financial statements are prepared when a

Q33: In a proposed <B>Statement,</B> "Consolidated Financial Statements: