Multiple Choice

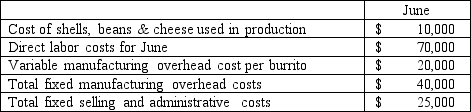

Burrito-Blast makes bean and cheese burritos that it sells to grocery stores. The burritos sell for $1 each. Burrito-Blast had beginning inventory of $20,000 on June 1 for 80,000 burritos. During June the company produced 500,000 burritos. June production costs are as follows:

- The company's June 30 ending inventory consists of 20,000 burritos. Assuming they use FIFO costing, calculate the June net income using absorption costing?

A) $358,200

B) $379,000

C) $340,400

D) $380,600

Correct Answer:

Verified

Correct Answer:

Verified

Q59: Burrito-Blast makes bean and cheese burritos that

Q60: Assuming no beginning inventory, if production is

Q61: Variable costing considers all costs to be

Q62: Selling and administrative expenses (such as commissions

Q63: Pat's Hats produces sun visors. Production data

Q65: Burrito-Blast makes bean and cheese burritos that

Q66: Harold's produces windmills that store power for

Q67: Hi-Tech manufactures basic cell phones for cell

Q68: During the current period, 20,000 units were

Q69: If a company's beginning and ending inventory