Multiple Choice

Answer the following questions using the information below:

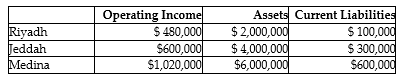

Yasir Company has two sources of funds: long-term debt with a market and book value of $5 million issued at an interest rate of 12%, and equity capital that has a market value of $4 million (book value of $2 million) . Yasir Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 25%.

-What is the EVA for Medina?

A) $557,820

B) $207,180

C) $765,000

D) $225,000

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Answer the following questions using the information

Q7: Answer the following questions using the information

Q8: Answer the following questions using the information

Q9: Answer the following questions using the information

Q10: Answer the following questions using the information

Q12: The Coffee Division of Arabian Coffee Products

Q13: Answer the following questions using the information

Q14: Answer the following questions using the information

Q15: Answer the following questions using the information

Q16: Answer the following questions using the information