Essay

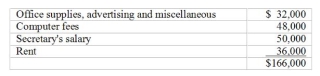

Lucy Cook, CPA, J.D., provides accounting and tax and legal services to her clients. In 2007, she charged $175 per hour for accounting and $200 per hour for tax and legal services. Erin estimates the following

costs for the year 2008.

costs for the year 2008.

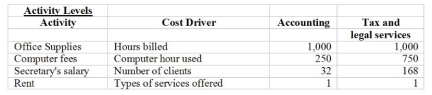

Operating profits declined last year and Ms. Cook has decided to use activity based costing ABC. procedures to evaluate her hourly fees. She has gathered the following information from last year's

records:

records:

Required:

(a) What is the total cost allocated to Accounting services using Activity-Based costing ABC.?

(b) Lucy wants her hourly fees for the tax and legal services to be 200% of their activity-based costs. What is the fee per hour for each type of service Lucy offers?

(c) A major client has requested accounting services. However, Lucy is already billing 100% of her capacity (2,000 hours per year) and is reluctant to shift 200 hours away from her tax and legal services to meet this client's request. What is the minimum fee per hour that Lucy could charge this client for accounting services and be no worse off than last year? Assume that Activity-Based Costing ABC. is used.

(d) Without regard to your answer in requirement c, assume that Lucy must charge $300 per hour to shift the client's work from tax and legal services to accounting services. What would you advise Lucy to do?

Correct Answer:

Verified

(a)

(b)

(b)

(c)

Last year's profits = $1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(c)

Last year's profits = $1...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q60: Setting up manual and computer controlled machines

Q61: Assume the role of Belinda Taylor. Think

Q62: The review of each tax return by

Q63: Which of the following statements regarding traditional

Q64: Use the following to answer questions:<br>The Dedham

Q66: Consider the following information for Basin Head

Q67: Customer costing analyzes the costs of activities

Q68: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB9775/.jpg" alt=" Match each of

Q69: Which of the following is not a

Q70: ABC costing information can be useful for