Essay

Job 100 incurred 700 machine hours in Department 1 and 75 in department 2 and 200 manufacturing labor hours in department 1 and 250 in department 2. The company uses a budgeted departmental overhead rate for applying overhead to production. Job 100 consisted of 3,000 lamps.

Required:

Calculate the total cost and per unit cost of Job 100.

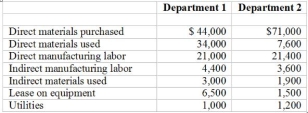

Osterville Manufacturing produces lamps for large department stores. For 2007, the two production departments had budgeted allocation bases of 100,000 machine hours in Dept 1 and 50,000 direct manufacturing labor hours in Department 2. The budgeted manufacturing overheads for 2007 were $1,200,000 for Dept. 1 and $1,000,000 for Dept. 2. For Job 100, the actual costs incurred in the two departments were as follows:

Correct Answer:

Verified

Correct Answer:

Verified

Q60: In a job-order costing system, the journal

Q61: Precision Measurement Company manufactures precision-measuring devices used

Q62: A Gantt chart:<br>A) Shows which jobs are

Q63: Hudson Company incurred $50,000 of depreciation expense

Q64: The basic cost flow equation in job

Q66: Use the following to answer questions:<br> <img

Q67: Given the following: Transfers In $30,000; Transfers

Q68: A debit to Finished- Goods-Inventory will normally

Q69: Manufacturing Overhead applied was $60,000, while actual

Q70: The predetermined overhead rate is computed by