Essay

(a) Compute the contribution margin, operating income, and ending inventory for Bedell Metal Company

(b) Assume that sales of part D-1340 increases by 30 units to 110 units during the given period (production remains constant). Re-compute the above figures.

(c) Mary Keenan, the controller of Bedell Metal Company., is considering the use of absorption costing instead of variable costing to be in line with financial reporting requirements. She knows that the use of a different costing method will give rise to different incentives. Explain to her how alternative methods of calculating product costs create different incentives.

Additional information:

● Sales revenue: $20,000,000

● Beginning inventory: $1,150,000

● Sales of part D-1340: 80 units

● Sales of all other parts are the same as the number of units produced.

● Sales price of part D-1340: $35,500 per unit

● The only spending increase was for material cost due to increased production. All other spending as shown above was unchanged.

Bedell Metal Company uses the variable costing method.

Required

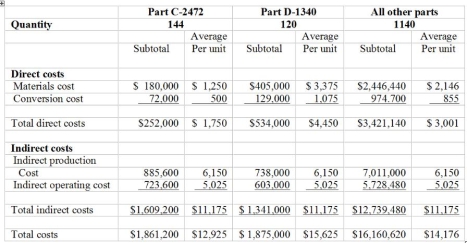

Consider the following cost and production information for Bedell Metal Company, Inc.

Correct Answer:

Verified

(a)

Note: Variable cost of goods sold ...

Note: Variable cost of goods sold ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Absorption costing uses sales less variable costs

Q7: All variable costs are unit-level costs.

Q8: The identification of a cost as fixed

Q9: Which of the following statements is True?<br>A)

Q10: (a) Compute the gross margin, operating income,

Q12: The difference in the amount of fixed

Q13: Fixed costs per unit remain the same

Q14: Consider the following cost and production information

Q15: Classify each of the following costs as

Q16: Cost of goods sold does not include