Multiple Choice

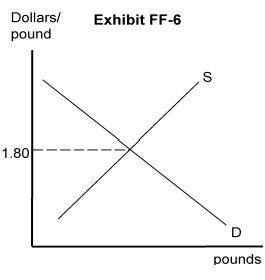

-In Exhibit FF-6, the market-determined exchange rate of dollars per British pound is 1.80. If the exchange rate is fixed at $1.90 per pound, then

A) the United States would face a trade surplus

B) the United States would face a trade deficit

C) Great Britain would face a trade surplus

D) British exports would exceed their imports

E) the dollar price for pounds is too high

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Fixed exchange rates require governments to have<br>A)

Q19: With the increasing normalization of relations with

Q20: If interest rates in Canada fall below

Q21: Suppose a U.S.-made machine costs $500 and

Q22: All of the following are examples of

Q24: An increase in Mexican incomes will have

Q25: When two people from two different nations

Q26: Import controls in Mexico _.<br>A) will ease

Q27: A favorable balance of trade occurs when

Q28: Explain how an increase in American interest