Multiple Choice

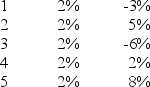

What is the correlation coefficient between the following two investments? Year Return A Return B

A) Positive

B) Negative

C) Zero

D) Unable to determine without knowing the covariance

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q18: Which of the following statements about option

Q19: What is the essential difference between a

Q20: Exchange rate losses arise when the value

Q21: Which of the following statements about the

Q22: Which of the following is <u>not</u> an

Q24: What is the correlation coefficient between the

Q25: Which of the following statements about Enterprise

Q26: When two investments have a negative correlation

Q27: One of the benefits of bearing risk

Q28: Currency risk is risk associated with the