Multiple Choice

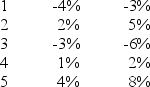

What is the correlation coefficient between the following two investments? Year Return A Return B

A) Positive

B) Negative

C) Zero

D) Unable to determine without knowing the covariance

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q40: Is there a reason why pure risk

Q41: Which of the following statements about option

Q42: If the covariance between two stocks is

Q43: Which of the following is not an

Q44: Which of the following statements about bearing

Q46: Calculate the Standard Deviation of the following

Q47: Which of the following is not correct

Q48: Explain the importance of the correlation coefficient

Q49: When the option holder decides to exercise

Q50: Which of the following statements about risk-bearing