Multiple Choice

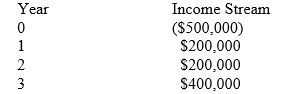

Given the following income stream, if the rate of return on a three-year U.S. Treasury note was currently 5 percent, what decision would you make about the possible investment?

A) it would most likely be a poor investment

B) it would most likely be a good investment

C) it could be positive or negative

D) there is not enough information to be able to judge

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Fixed costs are costs that are independent

Q19: Decision trees are a way to create

Q20: Given the following table of dimension weights,

Q21: Which decision-making tool limits decision making to

Q22: Under what circumstances would a real-option analysis

Q24: Describe the various tools available to assist

Q25: Which decision making tool that provides the

Q26: Which decision-making tool provides a quantitative evaluation

Q27: Which project map category would include efforts

Q28: What quantitative method for evaluating innovative projects