Multiple Choice

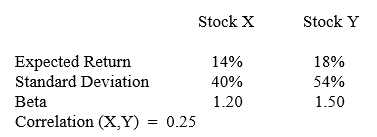

The questions relate to the following table of information:

-What is the beta for a portfolio with 60% invested in X and 40% invested in Y?

A) 1.12

B) 1.22

C) 1.32

D) 1.42

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q40: There are 1,700 stocks in the Value

Q41: A security has a return variance of

Q42: The variance of a two-security portfolio decreases

Q43: The covariance of a random variable with

Q44: The least risk portfolio is called the<br>A)

Q45: Suppose Stock M has an expected return

Q47: As portfolio size increases, the variance of

Q48: The questions relate to the following table

Q49: COV (A,B) = .335. What is COV

Q50: A security has a return variance of