Multiple Choice

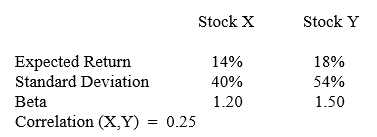

The questions relate to the following table of information:

-What is the covariance between Stock X and Stock Y?

A) 0.025

B) 0.033

C) 0.047

D) 0.054

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: For a six-security portfolio, it is necessary

Q3: Security A has a beta of 1.2;

Q4: Suppose Stock M has an expected return

Q5: Knowing beta, determining the portfolio with a

Q6: Securities A, B, and C have betas

Q7: Suppose Stock M has an expected return

Q8: COV (A,B) is equal to<br>A) the product

Q9: Securities A and B have expected returns

Q10: A diversified portfolio has a beta of

Q11: Suppose Stock M has an expected return