Multiple Choice

Figure 15.2

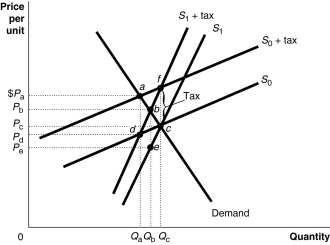

Figure 15.2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 15.2.If the government imposes an excise tax of $1.00 on every unit sold, the government's revenue from the tax is represented by the area

A) (PₐPc × Qₐ) if the supply curve is S₀ and (PbPc × Qb) if the supply curve is S₁.

B) (PₐPd × Qₐ) if the supply curve is S₀ and (PbPₑ × Qb) if the supply curve is S₁.

C) (PₐPₑ × Qₐ) under either supply curve.

D) (PbPₑ × Qb) under either supply curve.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: A marginal tax rate is calculated as<br>A)total

Q78: Figure 15.4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4178/.jpg" alt="Figure 15.4

Q78: What is the difference between the voting

Q80: Table 15.4<br> <span class="ql-formula" data-value="\begin{array}{|c|c|}\hline

Q82: As the value of the Gini coefficient

Q84: Why would most people not consider a

Q92: "Sin taxes," such as taxes on alcoholic

Q153: What is meant by the term "rational

Q158: All of the following occur whenever a

Q196: If, as your taxable income decreases, you