Multiple Choice

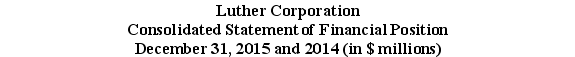

Use the table for the question(s) below.

-Refer to the statement of financial position above.If in 2015 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then Luther's stock would be considered to be:

A) undervalued.

B) overvalued.

C) a growth stock.

D) a value stock.

E) worthless.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: A firm has EBIT of $4.5 million,interest

Q18: Use the table for the question(s)below.<br> <img

Q19: Use the table for the question(s)below.<br>Statement of

Q20: Which of the following best describes why

Q21: According to the text,did Enron follow Generally

Q23: Which of the following firms would be

Q24: A firm has EBIT of $24 million

Q26: A firm has EBIT of $29 million,interest

Q27: What is the need for the notes

Q78: What role does Generally Accepted Accounting Principles