Multiple Choice

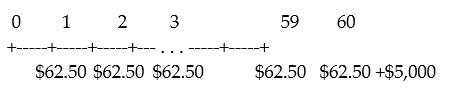

A corporation issues a bond that generates the above cash flows.If the periods shown are 3 months,which of the following best describes that bond?

A) a 15-year bond with a notional value of $5000 and a coupon rate of 5% paid quarterly

B) a 15-year bond with a notional value of $5000 and a coupon rate of 1.25% paid annually

C) a 30-year bond with a notional value of $5000 and a coupon rate of 3.75% paid semi-annually

D) a 60-year bond with a notional value of $5000 and a coupon rate of 5% paid quarterly

E) a 30-year bond with a notional value of $5000 and a coupon rate of 2.5% paid semi-annually

Correct Answer:

Verified

Correct Answer:

Verified

Q14: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1618/.jpg" alt=" A mining company

Q16: Use the information for the question(s)below.<br>Luther Industries

Q25: A corporate bond which receives a BBB

Q40: A bond,which is currently trading at $3440,has

Q46: A company releases a five-year bond with

Q49: A Government of Canada zero-coupon bond has

Q65: Use the figure for the question(s)below. <img

Q94: A $5000 bond with a coupon rate

Q100: What is the yield to maturity of

Q105: What care, if any, should be taken