Multiple Choice

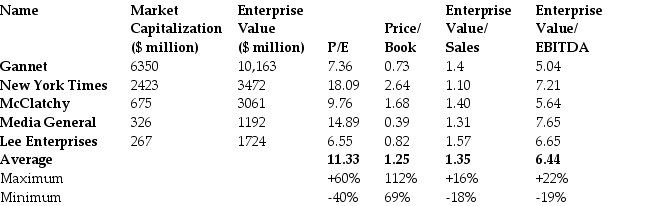

Use the table for the question(s) below.

-Valuation models use the relationship between share value,future cash flows,and the cost of capital to estimate these quantities for a given firm.Realistically,for a publicly traded firm,what can we reliably use such models to determine? I.the firm's future cash flows

II the firm's cost of capital

III the firm's stock price

A) I only

B) II only

C) III only

D) I and II

E) II and III only

Correct Answer:

Verified

Correct Answer:

Verified

Q21: What are the major limitations of the

Q27: If a manager wishes to raise his

Q27: Northern Railways has a current stock price

Q33: Which of the following situations is a

Q41: Matilda Industries pays a dividend of $2.25

Q69: If you want to value a firm

Q89: The net present value (NPV)of a stock

Q96: Wellington Corporation is expected to pay a

Q98: You expect KT industries (KTI)will have earnings

Q114: Use the table for the question(s)below.<br> <img