Multiple Choice

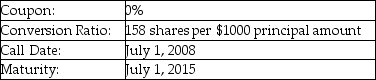

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $6.58.What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

A) par

B) par plus 0.6%

C) par plus 4%

D) par plus 6%

E) par plus 8%

Correct Answer:

Verified

Correct Answer:

Verified

Q12: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1618/.jpg" alt=" A firm issues

Q24: A company issues a callable (at par)five-year,7%

Q48: A company issues a callable (at par)ten-year,6%

Q50: A company issues a 20-year,callable bond at

Q69: A bond that makes payments in a

Q71: A bond has a face value of

Q92: What are callable bonds?

Q95: Alberta Energy issues $150 million in straight

Q99: A firm issues $500 million in twenty-year

Q104: Covenants in a bond contract restrict the