Multiple Choice

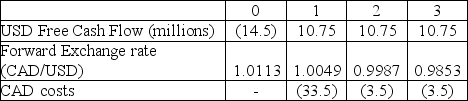

Use the table for the question(s) below.

-You own a Canadian firm that invests in a U.S.project with the cash flows shown in the table above.Given a corporate tax rate of 40% and a WACC of 8.9%,what is the NPV of the investment?

A) $9.3 million CAD

B) $0.1 million CAD

C) -$0.1 million CAD

D) $7.5 million CAD

E) $7.2 million CAD

Correct Answer:

Verified

Correct Answer:

Verified

Q67: All investors in the developed and developing

Q72: Exchange rate risk exists if the firm's

Q88: Canadian tax liabilities are _ until the

Q89: What is the best explanation for the

Q90: Your firm needs to pay its British

Q92: The spot exchange rate for the British

Q94: The one-year forward exchange rate is 45

Q95: Consider the following equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt="Consider

Q97: The spot exchange rate for Indian rupees

Q98: A firm wants to hedge a potential