Essay

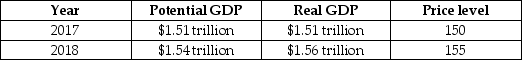

Suppose the following table illustrates the values of real and potential GDP and the price level, if the Reserve Bank of Australia (RBA)does not change its current policy to be more contractionary or expansionary.

If the RBA wants to keep real GDP at its potential level in 2018, should the RBA use a contractionary or expansionary policy? Should it raise or lower its interest rate target? How should it conduct open market operations to achieve its goal?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Correct Answer:

Verified

The information in the table indicates t...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: When the RBA uses contractionary policy:<br>A)the price

Q47: What is the function of 'exchange settlement

Q48: The Reserve Bank of Australia manages the

Q49: The Reserve Bank of Australia can increase

Q51: Not all households are net borrowers. For

Q52: Falling interest rates can:<br>A)increase a firm's share

Q53: From an initial long-run macroeconomic equilibrium, if

Q54: Which of the following characterises the ability

Q55: A 'liquidity trap' is a situation in

Q93: Explain why the money demand curve is