Multiple Choice

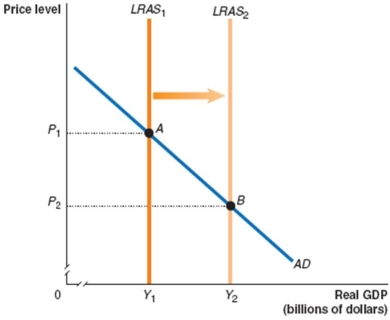

Refer to Figure 13.6 for the following questions.

Figure 13.6

-Suppose the federal government reduces income taxes. Assume that the movement from A to B in Figure 13.6 represents normal growth in the economy before the tax change. Also assume that aggregate demand does not change. If the tax change is effective and labour supply and savings increase because of the tax change, then the tax change will:

A) shift LRAS₂ to the right.

B) decrease output to less than Y₂.

C) not change the price level.

D) decrease the price level to less than P₁, but more than P₂.

Correct Answer:

Verified

Correct Answer:

Verified

Q43: If policy makers implement expansionary fiscal policy

Q45: Suppose that the nominal wage, the expected

Q46: Crowding out results in:<br>A)higher interest rates, a

Q47: Refer to Figure 13.1 for the following

Q49: Assume that the federal government gives a

Q50: Suppose that the federal budget is balanced

Q51: Reducing the marginal tax rate on individual

Q99: The tax multiplier is calculated as "one

Q258: What is fiscal policy,and who is responsible

Q285: In the case of an upward-sloping aggregate