Essay

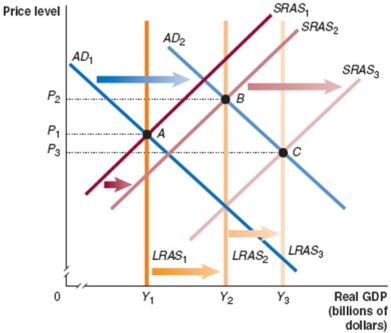

Show the impact of tax reduction and simplification using the dynamic aggregate demand and aggregate supply model. Clearly show and identify the impact of the tax change. Show what happens to the price level and real GDP because of the tax change.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Correct Answer:

Verified

The economy's initial equilibrium is at ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: The government 'purchases multiplier' always has a

Q7: Suppose that the nominal wage, the expected

Q8: Refer to Figure 13.4 for the following

Q9: Identify each of the following as (i)part

Q10: If increasing government spending also increases the

Q13: Fiscal policy is quicker to implement than

Q14: Suppose that the government allocates $2 billion

Q15: Milton Friedman argued that there is a

Q16: Induced taxes and transfer payments reduce the

Q233: How can tax simplification be beneficial to