Multiple Choice

Figure 4-8

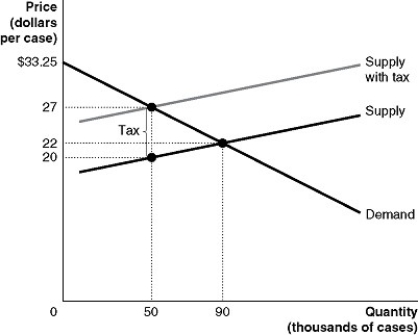

Figure 4-8 shows the market for beer. The government plans to impose a per-unit tax in this market.

-Refer to Figure 4-8.As a result of the tax, is there a loss in consumer surplus?

A) Yes, because consumers pay a price above the economically efficient price.

B) No, because the producer pays the tax.

C) No, because the market reaches a new equilibrium

D) No, because consumers are charged a lower price to cover their tax burden.

Correct Answer:

Verified

Correct Answer:

Verified

Q66: Marginal cost is<br>A)the total cost of producing

Q67: Table 4-2<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Table 4-2

Q68: Suppose a binding price floor on sparkling

Q69: Economic efficiency is defined as a market

Q70: Figure 4-4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 4-4

Q72: Suppose an excise tax of $1 is

Q73: When a competitive equilibrium is achieved in

Q74: Figure 4-3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 4-3

Q75: Paul goes to Dick's Sporting Goods to

Q76: The following equations represent the demand and