Multiple Choice

Figure 4-9

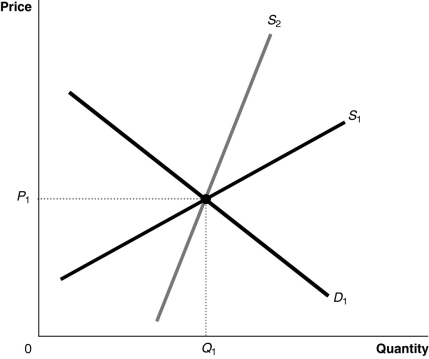

-Refer to Figure 4-9.Suppose the market is initially in equilibrium at price P₁ and now the government imposes a tax on every unit sold.Which of the following statements best describes the impact of the tax? For demand curve D₁

A) the producer bears a greater share of the tax burden if the supply curve is S₂.

B) the producer bears a greater share of the tax burden if the supply curve is S₁.

C) the producer's share of the tax burden is the same whether the supply curve is S₁ or S₂.

D) the producer bears the entire burden of the tax if the supply curve is S₁ and the consumer bears the entire burden of the tax if the supply curve is S₂.

Correct Answer:

Verified

Correct Answer:

Verified

Q191: Figure 4-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 4-1

Q192: Table 4-6<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Table 4-6

Q193: If the quantity of sunglasses supplied is

Q194: Table 4-2<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Table 4-2

Q195: Table 4-3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Table 4-3

Q197: Figure 4-4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 4-4

Q198: Figure 4-4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 4-4

Q199: Figure 4-6<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 4-6

Q200: Which of the following is not a

Q201: Figure 4-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 4-1