Multiple Choice

Table 18-6

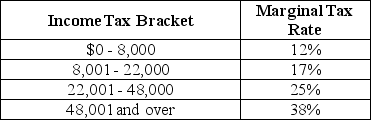

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Calpernia.

-Refer to Table 18-6.Sasha is a single taxpayer with an income of $60,000.What is his marginal tax rate and what is his average tax rate?

A) marginal tax rate = 38%; average tax rate = 23%

B) marginal tax rate = 17%; average tax rate = 21%

C) marginal tax rate = 38%; average tax rate = 24%

D) marginal tax rate = 23%; average tax rate = 38%

Correct Answer:

Verified

Correct Answer:

Verified

Q75: Table 18-9<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Table 18-9

Q76: Which of the following is a transfer

Q77: For the top 1 percent of income

Q78: What is the difference between the voting

Q79: What is rent seeking and how is

Q81: Consider the following methods of taxing a

Q82: As the value of the Gini coefficient

Q83: The public choice model can be used

Q84: What is the United States government's formal

Q85: Which of the following is an example