Multiple Choice

Table 18-7

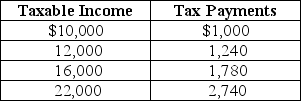

Table 18-7 shows the amount of taxes paid on various levels of income.

-Refer to Table 18-7.The tax system is

A) progressive throughout all levels of income.

B) proportional throughout all levels of income.

C) regressive throughout all levels of income.

D) progressive between $10,000 and $12,000 of income and regressive between $16,000 and $22,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Rapid economic growth tends to increase the

Q31: For a given supply curve, the deadweight

Q32: Financial contributions to the campaigns of members

Q33: Which of the following summarizes the information

Q34: Absolute poverty measures vary from country to

Q36: Article Summary<br>State tax revenue from marijuana sales

Q37: Which of the following tax systems would

Q38: An example of a payroll tax in

Q39: When members of Congress vote to pass

Q40: A marginal tax rate is calculated as<br>A)total