Essay

Table 18-10

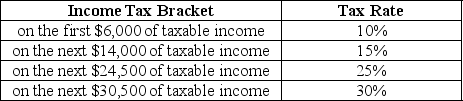

Table 18-10 shows the income tax brackets and tax rates for single taxpayers in Bauxhall.

-Refer to Table 18-10.A tax exemption is granted for the first $10,000 earned per year.Suppose you earn $75,000.

a.What is the amount of taxes you will pay?

b.What is your average tax rate?

c.What is your marginal tax rate?

Correct Answer:

Verified

a.($6,000 × 0.10)+ ($14,000 × ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: An example of a payroll tax in

Q39: When members of Congress vote to pass

Q40: A marginal tax rate is calculated as<br>A)total

Q41: Table 18-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Table 18-1

Q42: There is a difference between who is

Q44: A Gini coefficient of _ means that

Q45: In 2016, which type of tax raised

Q46: What is the poverty rate?<br>A)the rate at

Q47: As the value of the Gini coefficient

Q48: Since lower-income people spend a larger proportion