Multiple Choice

Figure 18-2

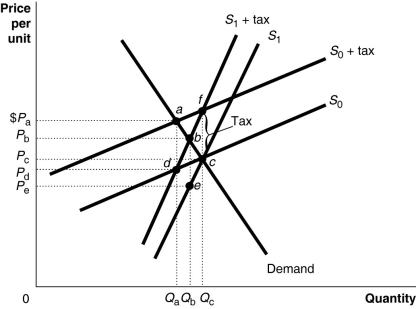

Figure 18-2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 18-2.If the government imposes an excise tax of $1.00 on every unit sold, the consumer's burden of the tax

A) is Pₐ - Pc under either supply curve.

B) is Pb - Pc under either supply curve.

C) is Pₐ - Pc if the supply curve is S₀ and Pb - Pc if the supply curve is S₁.

D) is Pₐ - Pd if the supply curve is S₀ and Pb - Pₑ if the supply curve is S₁.

Correct Answer:

Verified

Correct Answer:

Verified

Q142: The Arrow impossibility theorem states that<br>A)no system

Q143: The marginal tax rate is<br>A)the amount of

Q144: What is logrolling?<br>A)a situation where a policymaker

Q145: The excess burden of a tax<br>A)measures the

Q146: The public choice model asserts that the

Q148: Consider a public good such as fire

Q149: When the demand for a product is

Q150: What is the difference between a marginal

Q151: All Gini coefficients must lie between 0

Q152: U.S.taxpayers spend many hours during the year