Multiple Choice

Figure 18-2

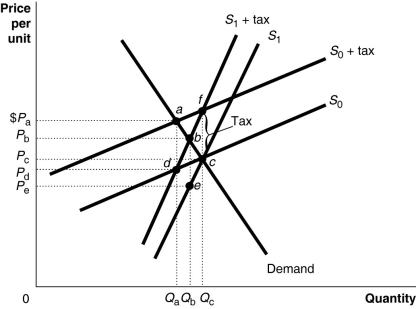

Figure 18-2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 18-2.If the government imposes an excise tax of $1.00 on every unit sold, the consumer's burden of the tax

A) is greater under the more elastic supply curve S₀.

B) is greater under the less elastic supply curve S₀.

C) is greater under the less elastic supply curve S₁.

D) is the same under either supply curve because there is a single demand curve that captures buyers' market behavior.

Correct Answer:

Verified

Correct Answer:

Verified

Q208: A key assumption of the public choice

Q209: A key insight of the public choice

Q210: A tax bracket is<br>A)the percent of taxable

Q211: The largest source of revenue for the

Q212: If grocery stores were legally required to

Q214: Unlike the market process, in the political

Q215: The federal corporate income tax is<br>A)regressive.<br>B)proportional.<br>C)progressive.<br>D)unfair.

Q216: The median voter theorem will be an

Q217: Of the following sources of tax revenue

Q218: The public choice model assumes that government