Multiple Choice

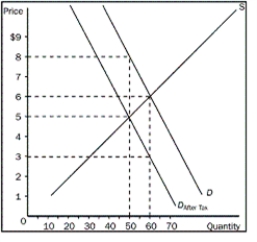

Figure 6-8

-Refer to Figure 6-8.What is the share of the tax burden that sellers would pay

A) $1.00 per unit

B) $1.50 per unit

C) $2.00 per unit

D) $3.00 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q50: If a tax is imposed on a

Q51: What happens if a binding price ceiling

Q52: Which statement best describes a price ceiling<br>A)A

Q53: Market demand is given as Q<sub>D </sub>=

Q56: Using the equations shown below,answer the following

Q57: What effect will a tax on the

Q58: On which side of the market does

Q59: What is a payroll tax<br>A)a tax on

Q60: What effect will a tax on sellers

Q108: Economic policies often have effects that their