Multiple Choice

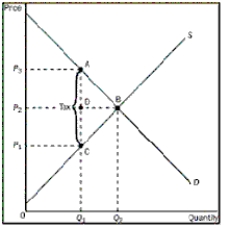

Figure 8-2

-Refer to Figure 8-2.What is the per unit burden of the tax on buyers

A) (P₃ - P₁) / (Q₂ - Q₁)

B) P₃ - P₂

C) (P₂ - P₁) / (Q₂ - Q₁)

D) P₂ - P₁

Correct Answer:

Verified

Correct Answer:

Verified

Q127: Figure 8-4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1272/.jpg" alt="Figure 8-4

Q128: Figure 8-4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1272/.jpg" alt="Figure 8-4

Q129: Figure 8-4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1272/.jpg" alt="Figure 8-4

Q130: If the supply of a good is

Q131: The larger the deadweight loss from taxation,the

Q133: What is total surplus with a tax

Q134: Assume that the demand for diamonds is

Q135: What must we do to fully understand

Q136: Figure 8-3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1272/.jpg" alt="Figure 8-3

Q137: When a tax is imposed,the loss of