Multiple Choice

Figure 8-6

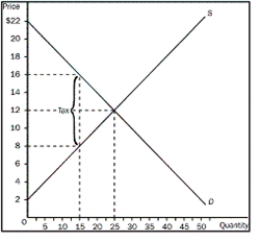

-Refer to Figure 8-6.What would producer surplus be after the tax is levied on the seller

A) $45

B) $75

C) $125

D) $150

Correct Answer:

Verified

Correct Answer:

Verified

Q94: A tax is imposed on a market

Q95: Figure 8-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1272/.jpg" alt="Figure 8-5

Q96: Figure 8-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1272/.jpg" alt="Figure 8-5

Q97: Figure 8-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1272/.jpg" alt="Figure 8-5

Q98: Given the supply of land is fixed,who

Q100: Consider a (per unit) tax on two

Q101: Using demand and supply diagrams,show the difference

Q102: Figure 8-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1272/.jpg" alt="Figure 8-5

Q103: A tax of $20 per unit is

Q114: As the size of a tax increases,