Multiple Choice

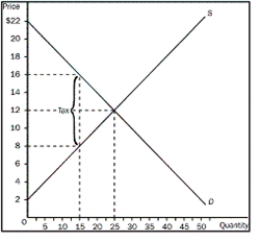

Figure 8-6

-Refer to Figure 8-6.What would the total surplus with the tax levied on the seller be

A) $210

B) $220

C) $230

D) $240

Correct Answer:

Verified

Correct Answer:

Verified

Q199: Figure 8-4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1272/.jpg" alt="Figure 8-4

Q200: Figure 8-6<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1272/.jpg" alt="Figure 8-6

Q201: Assume that a tax is levied on

Q202: Which effect on income tax collections is

Q203: Assume that the supply of gasoline is

Q205: What happens as elasticities of supply and

Q206: Figure 8-6<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1272/.jpg" alt="Figure 8-6

Q207: Which tax is the most important tax

Q208: Figure 8-3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1272/.jpg" alt="Figure 8-3

Q209: Which of the following effects is NOT