Multiple Choice

Table 12-1

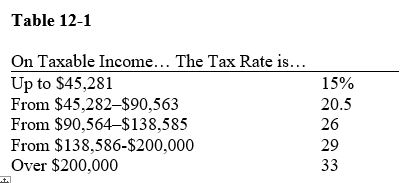

-Refer to Table 12-1.If Tressa makes $40,000 this year at her new job,what would her tax liability be,approximately

A) $4058

B) $6000

C) $7500

D) $10,450

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q116: In practice,Canadian income tax is filled with

Q117: What is the most efficient tax possible<br>A)a

Q118: What happens as a result of the

Q119: When is one tax system less efficient

Q120: Table 12-5 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1272/.jpg" alt="Table 12-5

Q122: Scenario 12-1<br>Suppose Jeremy and Kelsey receive great

Q123: Which tax is levied on the total

Q124: What will a tax on all forms

Q125: What are the three largest categories of

Q126: What is the difference between vertical equity