Multiple Choice

Table 12-3

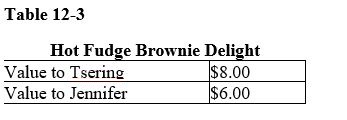

-Refer to Table 12-3.If the government imposes a $2.00 tax on Delights,causing the price to increase from $5.00 to $7.00,why does a deadweight loss arise

A) Jennifer will pay more tax as a percentage of her value of Delights than Tsering.

B) Tsering must pay the $2.00 tax from his consumer surplus.

C) Tsering will have to pay a higher price for Delights.

D) Jennifer will leave the market.

Correct Answer:

Verified

Correct Answer:

Verified

Q49: Tax evasion is legal, but tax avoidance

Q52: What is the most common explanation for

Q53: What does a person's tax liability refer

Q55: Why do taxes create deadweight losses<br>A)They reduce

Q56: Why are lump-sum taxes rarely used in

Q58: "A $1000 tax paid by a poor

Q59: What principle holds that people should pay

Q60: Table 12-4 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1272/.jpg" alt="Table 12-4

Q61: Who said,"In this world nothing is certain

Q62: What happens as tax laws become more